Explanation of 2025 Agricultural Productivity Values Click Here

Agricultural Application Deadline:Agricultural applications for 2025 tax year are due no later than April 30th

|

Application Requests:Periodically, Bell CAD will request an updated agricultural application in accordance with Art. VIII, Sec. 1-d-1 of the Texas Constitution in Chapter 23, Subchapter E, Texas Property Tax Code.Land must currently be devoted principally to agricultural use to the degree of intensity generally accepted in the area. |

_____________________________________________________________________________________

Agricultural Application Instructions & Online Form:

1-d-1 Agricultural Use Application – Instructions

Online Form: To log in click here

Late applications – if filed before the approval of the appraisal records by the ARB, will include a 10% penalty on tax difference.

____________________________________________________________________________________

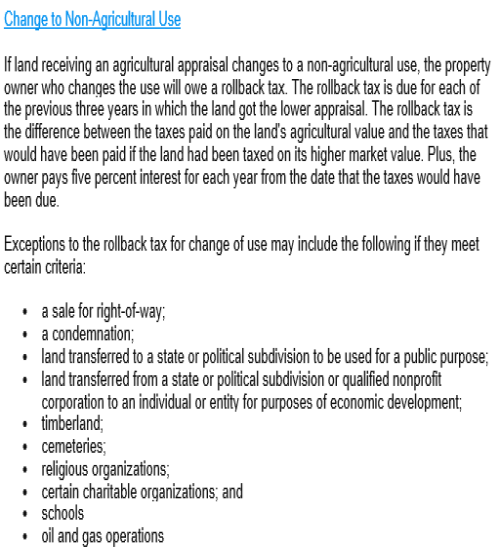

Rollback Tax Information

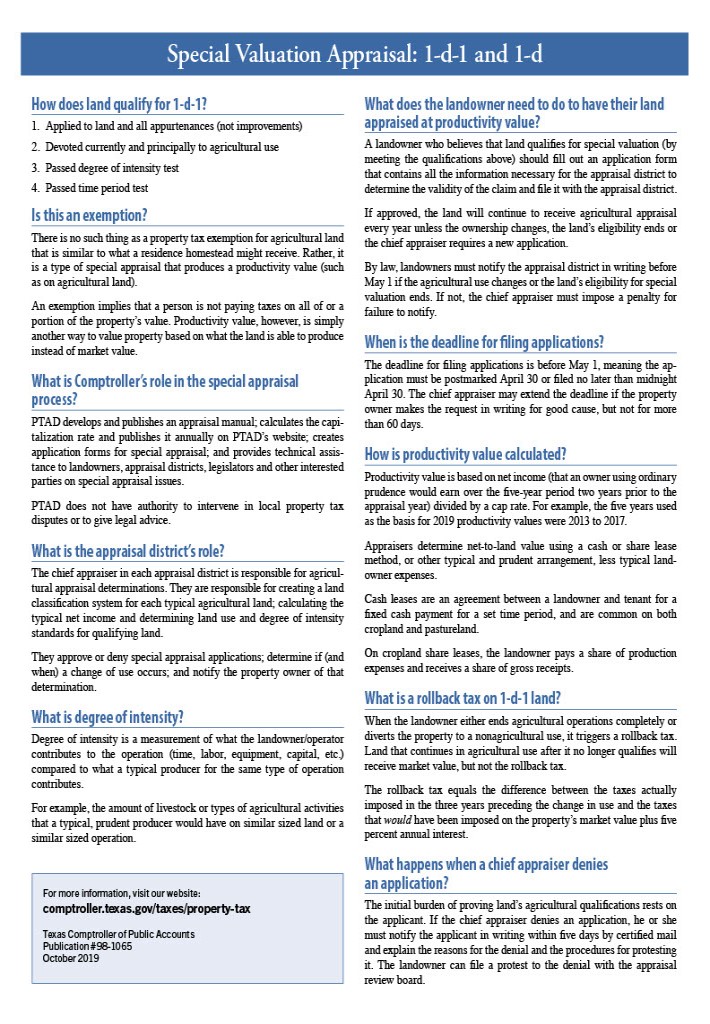

Comptroller Office – Assistance**

**For more information provided by the Comptrollers Office on Agricultural, Timberland AND Wildlife Management Use – SPECIAL APPRAISAL: Click Here